Netflix-WBD: Paramount’s Extended Hostile Tender (Part V)

TORONTO, ON –

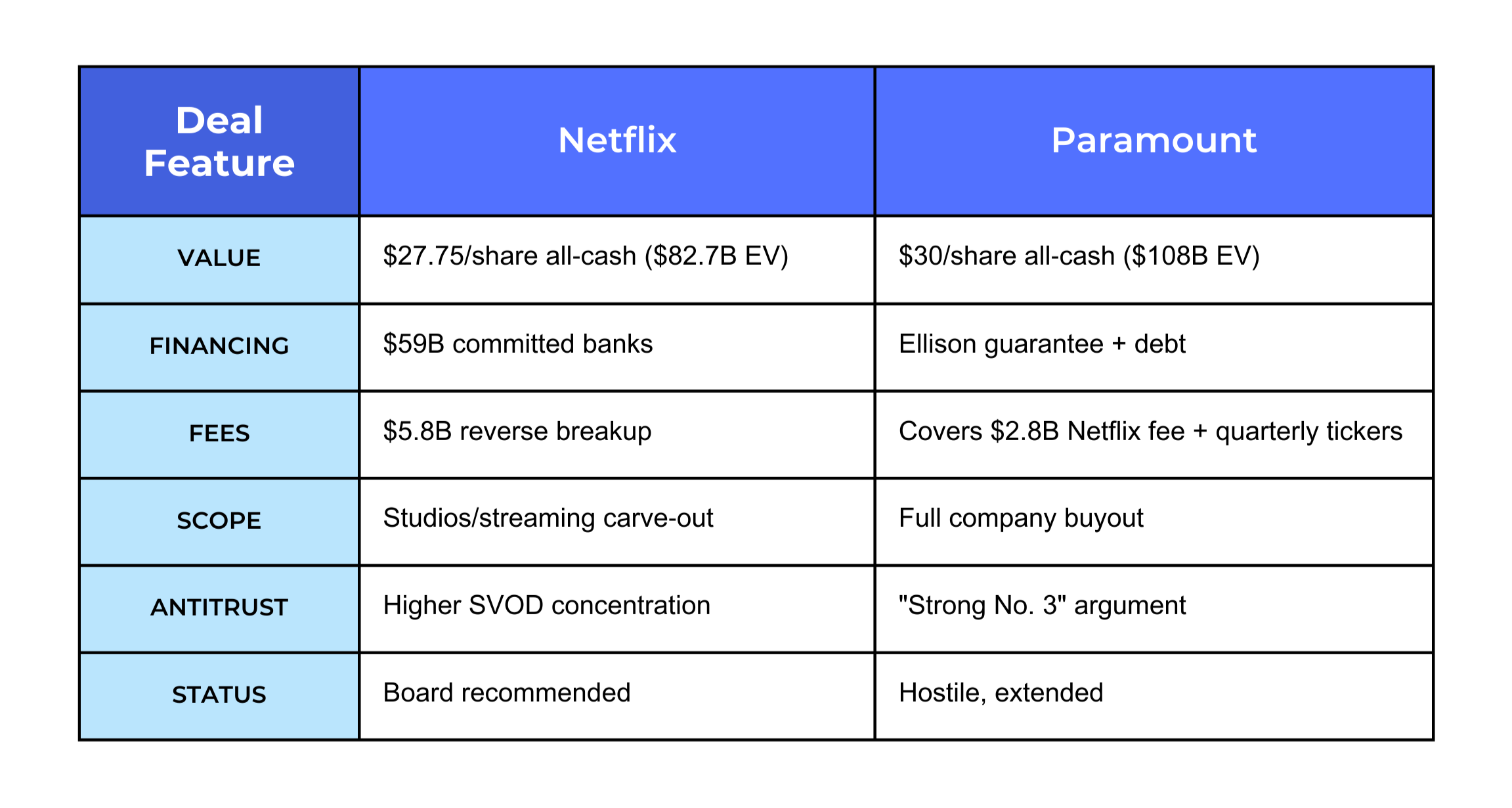

The Netflix–Warner Bros. Discovery (WBD) acquisition, which is now a pure all‑cash $82.7 billion deal for WBD’s studios and streaming assets, has evolved into a full‑blown regulatory and shareholder showdown.

Netflix Co‑CEO Ted Sarandos faced a Senate grilling on competition and jobs, U.S. President Trump disclosed $1 million+ bond bets on both sides, and Paramount Skydance escalated its hostile $108 billion counter with breakup‑fee enhancers. Meanwhile, the WBD board confronts Revlon‑style fiduciary pressures amid guild opposition and antitrust headwinds ahead of WBD’s upcoming shareholder vote in April 2026.

What does it all mean for creators in 2026?

Parts 1–4

Part 1 broke down the Netflix-WBD “spin‑merge” structure: Netflix buys WBD’s studios and HBO Max for $82.7 billion ($27.75/share cash + stock), spinning off CNN and cable into a shareholder stub company (holding corp for the remaining equity after a major distribution).

Part 2 covered Paramount’s hostile $30/share all‑cash bid for the whole company, sparking Revlon‑duty questions for WBD’s board.

Part 3 unpacked WBD’s rejection of Paramount’s bid, Ted Sarandos’ theatrical‑window pledge, and why Netflix’s deal now looks more regulator‑viable despite the lower price.

Part 4 discussed Paramount’s letter to US lawmakers calling the Netflix-WBD deal “presumptively unlawful” under antitrust laws and recapping the House Judiciary antitrust subcommittee hearing on the topic.

Since then, Paramount has extended its offer deadline by roughly one month, refusing to back down from its all‑cash bid despite WBD’s board unanimously reaffirming the Netflix merger as the superior choice.

With quarterly ticking fees, a pledge to cover the Netflix merger breakup fee, and Larry Ellison’s $43.3 billion backing, Paramount is forcing a WBD shareholder vote in April, increasing fiduciary scrutiny amid Senate testimony, Trump’s bond bets, guild opposition, and more.

All broken down here.

Paramount Deal Escalation

Hostile Tender Extension

Paramount extended its $108 billion hostile tender offer deadline for WBD to March 2, 2026, after the initial January 21 cutoff lapsed with insufficient tenders, and issued preliminary proxy materials to solicit shareholders votes AGAINST Netflix deal approval at the special meeting scheduled in March.

By bypassing the WBD board and going directly to shareholders with a higher share price, Paramount is betting that investor impatience with Netflix regulatory delays will force a pivot in its favour.

While the extension gives WBD shareholders more time to tender amid Netflix granting a 7‑day limited waiver for reopened talks (ending February 23), it also pressures WBD’s board to negotiate best-and-final terms and consider running a full auction process ahead of April’s shareholder meeting.

Fee Coverage and Ticking Incentives

Announced February 17, 2026, Paramount upped its $30/share all‑cash hostile bid ($108 billion EV) by offering to cover WBD’s full $2.8 billion Netflix termination fee, plus $650 million quarterly ticking fees to shareholders if the deal is delayed past 2026 and a $1.5 billion debt exchange.

To recap, Paramount’s deal sweeteners include:

Full coverage of WBD’s $2.8 billion Netflix termination fee.

$650 million quarterly escalators post‑2026.

$1.5 debt exchange incentives.

This announcement pressures WBD ahead of an expected April 2026 shareholder vote on the Netflix deal, and attempts to position Paramount as the superior option with greater certainty.

Defending the Deal

Senate Testimony

Netflix Co‑CEO Ted Sarandos testified February 2–3 before the Senate Judiciary Antitrust Subcommittee, defending against monopsony and foreclosure claims.

Grilled on jobs (155,000 created), theatrical release windows (45‑day theatrical commitment), and SVOD dominance, Sarandos positioned the Netflix deal as pro‑competitive “puzzle piece” that creates jobs and preserves theatrical windows.

Under fire from Sens. Mike Lee (R) and Cory Booker (D), Sarandos rebutted monopsony fears by citing Netflix’s 155,000 U.S. jobs and commitment to 45‑day theatrical releases for Warner films. He distinguished WBD’s linear and studio assets from Netflix’s SVOD core, downplaying foreclosure risks to rivals.

Sarandos’ testimony buys time but signals intensifying DOJ/FTC scrutiny on SVOD concentration and the job market.

Amplified Guild Concerns

WGA demanded regulators block the merger to protect writers from buyer consolidation, while SAG‑AFTRA insisted that any deal approval must guarantee job preservation and mandate more – not less – production:

WGA = hard block recommendation

They’re providing enforcers with a narrative of horizontal and monopsony harm focused on fewer buyers, job losses, and weaker bargaining power for writers and other creatives.

SAG‑AFTRA = conditional acceptance framing

They’ve highlighted the same consolidation and labour‑market risks, but positioned themselves to demand enforceable commitments on employment levels, production volume, and treatment of talent if regulators lean toward allowing the merger to proceed with remedies.

Government Backing

Trump’s December 2025 disclosures revealed $1 million+ in Netflix and WBD bonds that he acquired days after the deal announcement. This raises conflict of interest concerns, particularly following his comments confirming he’d be involved in the deal and his White House meeting with Sarandos.

Trump’s investment has also fuelled scrutiny from interested parties over WBD's board processes and speculation of a pro‑Netflix deal stance from the administration, potentially easing DOJ path despite Senate heat.

As the sitting president with DOJ oversight, Trump’s stake (two $500,000+ batches each) could signal tacit approval, countering Paramount’s “presumptively unlawful” antitrust pitch to lawmakers (discussed in Part 4). For WBD’s board, this bolsters Netflix’s political runway but invites activist lawsuits alleging rushed process favouritism.

Vertical Video and Mobile Roll-Out

Amid bid wars, Netflix has been testing a TikTok‑style vertical video feed rollout in its mobile app by late 2026, blending content from shows, films, and UGC to drive engagement, with plans to leverage clips from WBD’s HBO/DC library for engagement.

While co‑CEO Greg Peters called this a “key growth lever,” regulators may scrutinize its trend toward short‑form content as post‑merger foreclosure. This broadens Netflix’s competitive moat beyond SVOD, challenging YouTube/TikTok and rebutting monopoly claims in Sarandos’ testimony.

All Cash Structure

Netflix amended its offer to pure all‑cash ($27.75/share), garnering unanimous support board support from WBD, accelerating the shareholder vote timeline, and enhancing deal certainty in response to Paramount.

The deal is backed by about US$59 billion in fully committed bank financing from investment‑grade lenders, a record US$5.8 billion reverse break fee as compensation if antitrust blocks the deal, and the ability for WBD investors to retain upside through the (to be) separate, lower‑leveraged Discovery Global vehicle.

Comparative Review

Netflix is buying WBD’s film and TV studios, library, and streaming (HBO Max/Discovery+), not the entire conglomerate, with WBD’s remaining cable/sports and other assets to be spun into Discovery Global as its own company.

Paramount, by contrast, is pursuing a hostile, all‑cash tender for (effectively) the whole of WBD's shares and a significantly greater consolidation of linear TV, studio, and streaming assets into a single combined group.

On a purely economic level, Paramount offers a higher nominal per‑share price and premium, but it’s heavily reliant on incremental debt, sponsor support (via deal-backing by Larry Ellison’s $43.3 billion guarantee), and a more complex capital stack.

WBD’s board has characterized the Paramount offer as carrying “significant costs, risks and uncertainties” relative to the Netflix deal, which offers committed‑financing package, a very large reverse break fee, and a narrower, more remedy‑friendly perimeter that can be carved back in response to regulator pushback.

As expected, WBD’s board reaffirmed its support for the Netflix deal, emphasizing Netflix’s superior financing (no equity dilution, committed banks) over Paramount’s highly-leveraged structure and insisting that 93%+ of shareholders reject Paramount as inferior on risk‑adjusted value.

The shift from cash‑stock to all‑cash has sharpened scrutiny of: (a) board duties to consider deal certainty versus price, (b) debt‑load implications for Netflix’s capital structure, and (c) antitrust risk around horizontal overlaps in streaming and studios, including potential challenges on vertical foreclosure and monopsony theories in talent and content markets.

Legal Implications

Fiduciary‑duty perspective: It is easy to frame Netflix as the higher‑certainty, cleaner‑execution “strategic carve‑out,” and Paramount as the higher‑headline‑price but structurally riskier “full‑company recap” that could struggle in downside markets.

Anti-Trust: Netflix faces the more acute dominant platform and SVOD‑concentration narrative, whereas Paramount’s main exposure lies in old‑world TV, advertising, and labour/rights monopsony. Both present serious risk, but Netflix’s structure and remedies roadmap likely give it a clearer, if still contested, path to obtaining regulatory approval than a debt‑heavy, full‑company absorption by Paramount.

Since WBD’s board is pro-Netflix, to fulfill its Revlon obligation to maximize shareholder value, it must justify rejecting Paramount’s cash premium 8+ times, especially amid ticking fee incentives. Netflix’s deal structure could protect against antitrust blocks, but antitrust focus could also intensify if cash‑rich Netflix acquires WBD’s content powerhouse.

What’s Ahead

These developments, from February 2026, show the deal far from settled.

The April vote looms as the fiduciary flashpoint: will ticking fees force a preference pivot to Paramount, or will Netflix’s deal outcome certainty prevail?

The WBD board faces Revlon scrutiny: have they maximized value amid ticking incentives?

Paramount’s not waving the white flag. These new developments keep the auction alive into spring Shareholder vote, potentially forcing Netflix concessions or a higher bid.

Talent Takeaways

Tender extension heightens monopsony fears: fewer buyers, residual erosion, job cuts… as WGA/SAG push regulators hard.

Senate testimony ramps up regulatory risk (echoing guild calls to block), Trump’s investments add political intrigue, and Paramount’s fee coverage adds new dynamics to deal timing and costly delays for holdouts, potentially forcing deeper monopsony and competition analyses.

WGA demands outright blockage, warning of tightened control over writers via fewer buyers and eroded residuals. SAG‑AFTRA conditions approval on job growth and talent protections. A merged Netflix–WBD risks monopsony squeeze: flat fees over back‑ends, hiring slowdowns, and niche project cuts, despite franchise upsides for A‑listers.

For creators: expect guild leverage for streaming residual hikes if approved.

For TMT lawyers: a masterclass in poison‑pill avoidance, superior‑proposal duties, and monopsony defences.

Disclaimer: The Warner Bros. merger discussed is a developing story, and regulatory outcomes are subject to change.

Your creative work is your leverage.

Need help understanding the intricate contracts that govern your creative work, or want to build a strategy for IP protection? Diverge Legal is here to help.

If you’re ready for representation that understands the difference between a data point and your dream, contact Diverge today.

Read these next

More about DIVERGE

Diverge is not just a legal service provider. We’re your partner in building a legally sound and sustainable content creation business. We understand the unique challenges creators face and offer tailored solutions to protect your intellectual property, ensure regulatory compliance, and minimize legal risks.

Whether you’re an established influencer or an emerging creator, Diverge is here to help you focus on what you do best, while we take care of the legal complexities.

Reach out to Diverge today to learn more about how we can support your content creation journey.

Follow us social media or sign up to our newsletter below for more tips on protecting your creative rights and thriving in the creator economy.

Important Notice: The information in this article is provided for general informational purposes only and is not intended as legal advice. Reading this content does not create a lawyer-client relationship. Always seek professional legal counsel tailored to your specific situation. No part of this article may be reproduced or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in any retrieval system of any nature, without the express written permission of Diverge Legal.