Hostile Takeover: The $108 Billion War for Warner Bros. (Part II)

TORONTO, ON –

Seventy-two hours ago, the industry narrative was set: Netflix would acquire Warner Bros. Discovery’s (WBD) studios and streaming assets for $82.7 billion, effectively ending the Streaming Wars through consolidation.

We were wrong.

This isn’t a consolidation merger anymore; it is a live auction. For creators, shareholders, and regulators, the stakes have just jumped by $25 billion.

At Diverge, we look past the press release to the legal and business realities. Here is our deep dive into the takeover bid, the regulatory implications, and why independent creators need to pay attention.Hostile Tender Offer

Public offer to a company's shareholders to purchase a controlling interest in the company, bypassing board approval.Disclaimer: Image created using generative AI

In a move that shatters the gentleman’s agreement culture of modern media M&A, Paramount Skydance, led by CEO David Ellison, has launched a hostile, all-cash takeover bid for the entirety of WBD.

1. The Hostile Mechanics: Tender Offer vs. Merger Agreement

To understand the severity of this move, it’s important to distinguish between the process Netflix followed and the aggressive tactic Paramount has now deployed.

THE FRIENDLY ROUTE - NETFLIX

Netflix executed a Definitive Merger Agreement with the WBD Board. This is a negotiated contract where the target's board recommends that shareholders vote Yes. It is a collaborative process protected by deal terms like no-shop clauses and breakup fees.

THE HOSTILE ROUTE - PARAMOUNT

After having six private proposals rejected by the WBD Board over 12 weeks, Paramount has bypassed the boardroom entirely. They’ve launched a Tender Offer.

Approach: Paramount is soliciting WBD shareholders directly, asking them to tender (sell) their shares to Paramount for $30 cash per share.

Goal: If enough shareholders tender their stock (usually >50%), Paramount gains control of the company despite the Board's objection, effectively forcing a change of control.

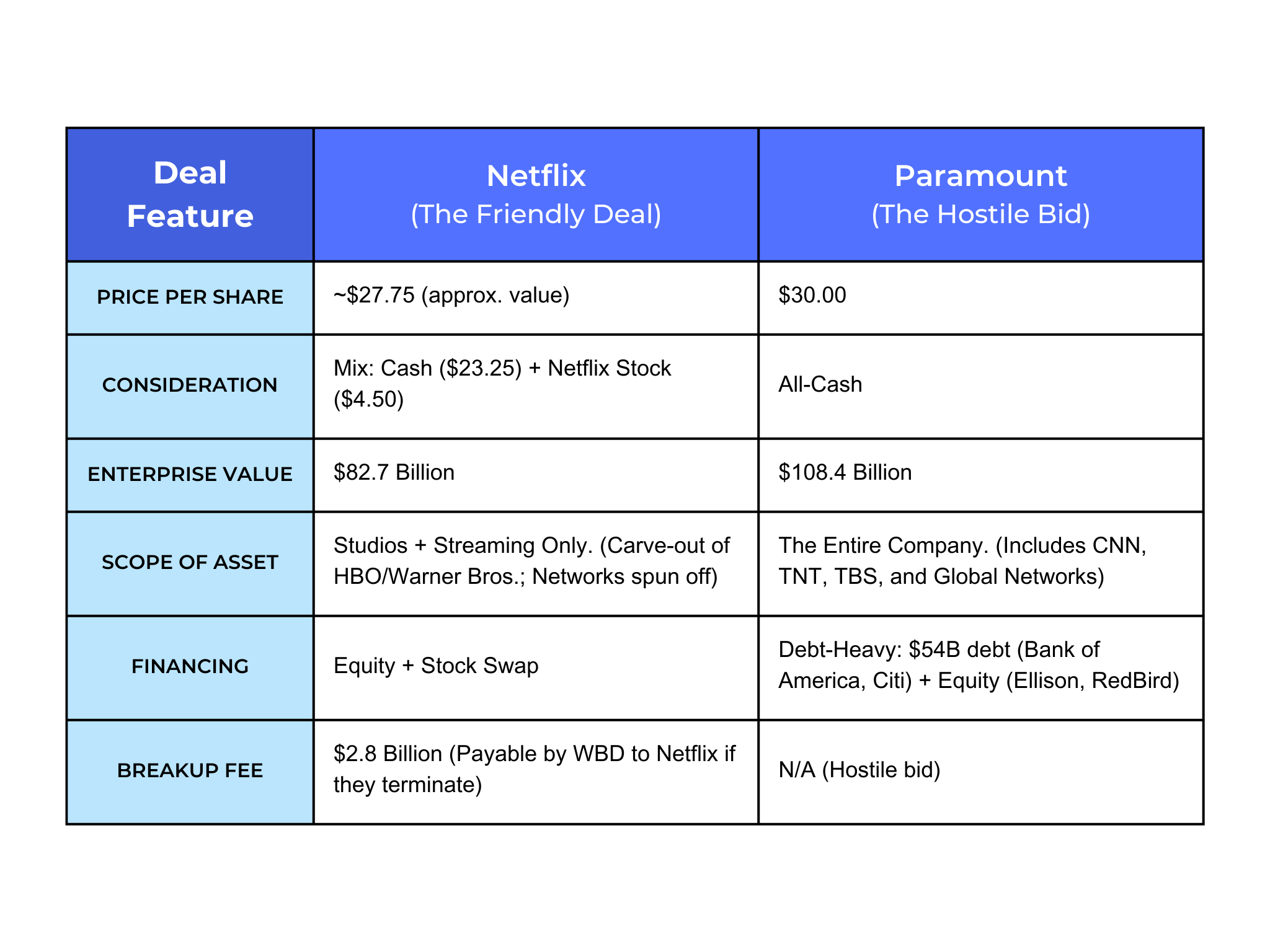

2. Deal Economics: A Side-by-Side Comparison

The choice for shareholders is now a stark calculation between certainty (cash) and strategy (stock or shares).

Deal Mechanics Comparison Chart:

3. The Rationale: David Ellison’s “Stronger Hollywood" Argument

David Ellison is pitching Paramount not just as the richer buyer, but as the pro-competitive alternative to Big Tech. Ellison argues that Paramount’s deal proposal offers key industry advantages, based on the following:

THE NETFLIX PROPOSAL IS INFERIOR:

Ellison argues the Netflix deal is financially inferior because it relies on volatile stock and leaves WBD shareholders holding the bag on a Global Networks spin-off that is highly leveraged and declining.

ANTI-MONOPOLY PITCH:

Paramount argues that merging Netflix (Top Streamer #1) with HBO Max (Top Streamer #3) creates unchecked market power.

By contrast, a Paramount-WBD merger combines Streamers #4 and #5 to create a legitimate competitor (approx. 200M subs) capable of challenging the Netflix/Disney duopoly.

THEATRICAL COMMITMENT:

Unlike Netflix’s digital-first model, Paramount promises to increase theatrical release output, positioning itself as the saviour of the cinema ecosystem.

4. The Legal & Regulatory Minefield

The hostile bid activates two massive legal triggers that will define the outcome:

i. The Fiduciary Duty Trap (The Revlon Standard)

The WBD Board is now in a precarious legal position. Under Delaware corporate law (where WBD is incorporated), once a company is in play for a cash sale, the Board's primary fiduciary duty shifts from long-term corporate strategy to maximizing immediate shareholder value (often referred to as Revlon duties).

LITIGATION RISK:

The Board has already recommended the lower Netflix deal ($27.75). If they continue to reject Paramount’s higher, all-cash offer ($30.00), they face immediate shareholder lawsuits alleging breach of fiduciary duty. They must justify why a lower, complex stock deal is better than immediate cash.

ii. The Merger Control Paradox

Both deals face anti-trust scrutiny, but for opposite reasons.

NETFLIX RISK:

Horizontal Concentration: This is a classic Monopsony threat (read: Part I). Combining the #1 and #3 platforms concentrates market share (potentially >35%) and buyer power over labour.

PARAMOUNT RISK:

Studio Consolidation: This combines two of the Big Five Hollywood studios (Paramount + Warner Bros.). While it creates a smaller streamer than the Netflix deal, it creates a colossus in film production, potentially reducing the number of studios bidding for scripts and harming theatre chains.

iii. Political Influence

The regulatory review is not purely objective. US President Donald Trump has already signalled that the market dominance resulting from the Netflix deal could be a problem. Furthermore, Paramount's bid includes financing from Affinity Partners, owned by Jared Kushner, adding a complex political dimension to the DOJ's antitrust review.

5. Legal & Market Analysis: Micro & Macro Outcomes

The industry is standing at a fork in the road.

SCENARIO A: NETFLIX WINS

The "Utility" Future:

Macro: Streaming becomes a consolidated utility. Content volume contracts.

Micro: Creators gain stability (one big check) but lose upside (residuals). The Warner Bros. identity is likely dissolved into the Netflix algorithm. WBD's debt is erased, but market power is centralized.

SCENARIO B: PARAMOUNT WINS

The "Hollywood" Future:

Macro: The Big Five studios become the Big Three. Theatrical windows are preserved, but the combined company is laden with massive new debt ($54 billion).

Micro: Pressure to cut costs will be extreme. We will likely see layoffs driven not by algorithm efficiency (Netflix), but by the crushing need to service debt (Paramount).

The Only Certainty is Volatility

Whether WBD is absorbed by a Tech Giant (Netflix) or leveraged by a Legacy Rival (Paramount), the result for the industry is contraction. The Growth Era of streaming is dead. The Consolidation Era has begun.

What’s On My Radar

December 19, 2025: The statutory deadline for the WBD Board to formally recommend for or against the Paramount tender offer.

The $2.8B Question: Will WBD risk paying the massive breakup fee to Netflix to switch sides?

The Guild Pivot: Will the WGA and DGA shift their attacks to Paramount, or do they view Ellison as the lesser of two evils?

Your creative work is your leverage.

In this rapidly changing digital era, your standard contract is obsolete before the ink dries. If you thought the Netflix news was big, the war for control of it has only just begun.

Disclaimer: The Warner Bros. takeover bid discussed is a developing story, and regulatory outcomes are subject to change.

Need help understanding the intricate contracts that govern your creative work, or want to build a strategy for IP protection? Diverge Legal is here to help.

If you’re ready for representation that understands the difference between a data point and your dream, contact Diverge today.

Read these next

More about DIVERGE

Diverge is not just a legal service provider. We’re your partner in building a legally sound and sustainable content creation business. We understand the unique challenges creators face and offer tailored solutions to protect your intellectual property, ensure regulatory compliance, and minimize legal risks.

Whether you’re an established influencer or an emerging creator, Diverge is here to help you focus on what you do best, while we take care of the legal complexities.

Reach out to Diverge today to learn more about how we can support your content creation journey.

Follow @diverge.legal on social media or subscribe to our newsletter below for more tips on protecting your creative rights and thriving in the creator economy.

Important Notice: The information in this article is provided for general informational purposes only and is not intended as legal advice. Reading this content does not create a lawyer-client relationship. Always seek professional legal counsel tailored to your specific situation. No part of this article may be reproduced or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in any retrieval system of any nature, without the express written permission of Diverge Legal.